Four Tips on Implementing a Private Exchange – and Retaining Employees

Private health insurance exchanges continue to attract greater employer interest. More businesses – and more types of businesses – are looking beyond a one carrier solution for their employee benefits. Private exchange enrollment was up in the first half of 2016 by more than one-third as compared to 2015. The Society of Human Resources Management (SHRM) says the movement is primarily driven by costs, administration, and employee/enrollee experience (and the desire by employers to offer more employee choice, while still controlling benefits costs). The publication Benefits Pro featured an article in September where one private exchange enthusiast shared her employer experience. Amy Natalie, who works in the hospitality industry, knows how important employee retention can be. Hospitality was the industry with the highest voluntary turnover rate (17.8 percent) in 2015, according to Compensation Force. In her experience as an HR professional, Amy noted in the article that her company tried many ways to boost employee retention – recognition programs, internal advancement opportunities, and ongoing training. But it was the 2015 implementation of a private exchange that notably – and positively – affected their organization-wide turnover and employee morale. If you’re considering a move to a private exchange we have brokers throughout California who can help you get started. Additionally, here are some suggested best practices:

Early engagement of leaders

Sharing information with leadership is essential to gaining ownership of the idea and selling the change across the organization. Her company was able to show how the change in their benefits program would enhance their ability to contain costs, expand employee choice, increase employee happiness, and boost employee retention. The executive launch included an exchange introduction, a demonstration video, and a webinar followed by an open dialogue to ensure leaders were champions of the exchange in their discussions with employees. Frequent communication drives enrollment Through the distribution of a pre-open enrollment packet to all departments, you can be sure all employees are aware of the planned shift to a private exchange. This gives them some time to adjust to the idea before facing open enrollment. Videos and flyers distributed in advance of enrollment can also help educate employees on the new marketplace and the benefit options available. Amy’s employer also held on-site enrollment meetings to demonstrate the enrollment website and discuss how employees would be able to shop and compare plans online.

Help your employees embrace change

At her company, all told, the organization dedicated six months to the roll-out of their private exchange. That might – or might not – work for your company, but they believed the longer introductory period was important to ensure a smooth launch and support by employees. They made themselves available for one-on-one meetings for a week after the large group open enrollment meetings. Computer kiosks were set up for those without their own device on which to enroll. Ongoing support was also offered for those needing assistance with the technology or answers to specific benefits questions. Decision Support Tools offered by their selected benefits administrator helped seal the deal.

Give your employees more choice

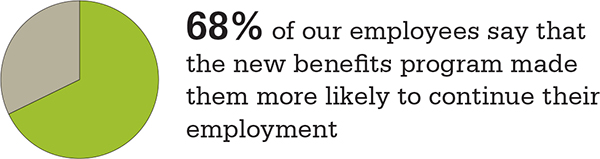

Employees love choice, and they want to feel they’re involved in making the right decisions for their individual or family health care choices. A private exchanges gives them that ability. While Amy’s company knew the private exchange would offer their employees greater flexibility, they were not sure how the move would affect each employee’s choices. Ultimately, eight in 10 employees selected a different health plan than they had in the prior year. The vast majority (96 percent) said they were satisfied with the choices offered through the new private exchange. A private exchange is a great way for employers of any size to manage their employee benefits. It empowers employees to play a bigger role in the selection of their health insurance and other benefits, while also giving employers a way to control costs (using Defined Contribution) and ensure compliance with the Affordable Care Act. Contact a CaliforniaChoice broker about implementing a private exchange – and improving your employee retention – at your organization.