Health care costs have been climbing for years and show no signs of slowing down. Increases to deductibles and copays have become the norm. For most small businesses, rising premiums are a frequent cause for concern. In the midst of rate increases, business owners want to know how much they should pay. It’s a simple question with a not-so-simple answer.

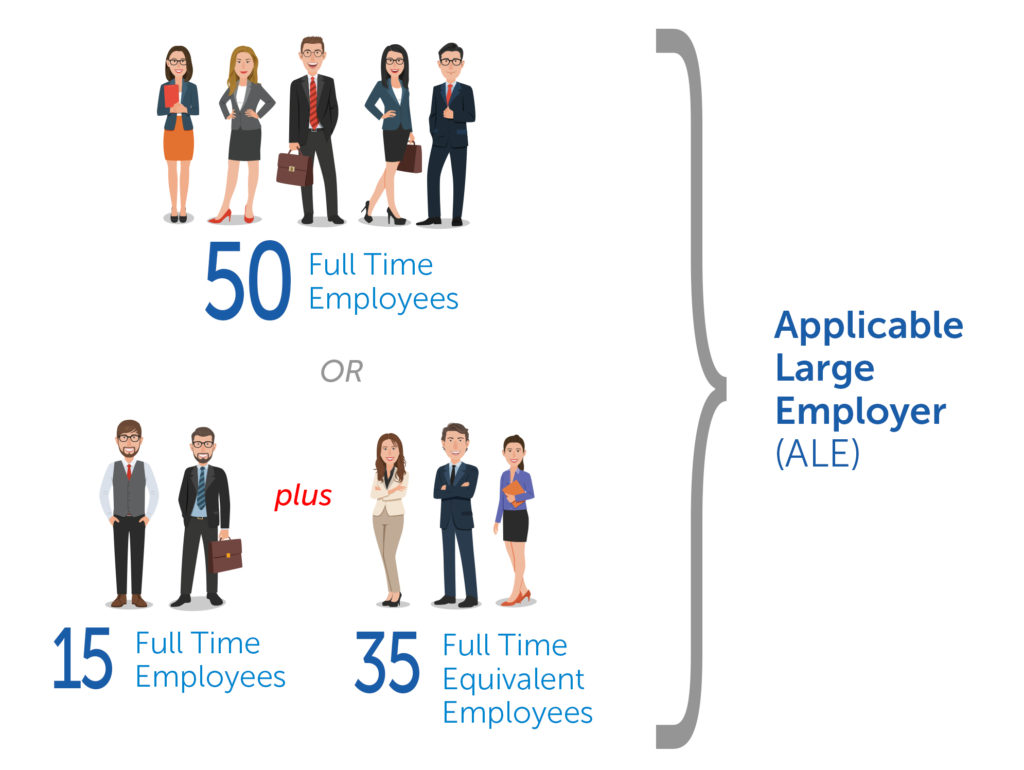

ALE Requirements

With all things health care, we must begin with the Affordable Care Act (ACA). The ACA defines an Applicable Large Employer (ALE) as an organization with 50 or more full-time and full-time equivalent (FTE) employees, on average, during the prior year. If you are an ALE, your organization is subject to the ACA employer shared responsibility provision and employer reporting requirements. For more information, visit the IRS website page on ALEs.

Under the shared responsibility provision, the health insurance coverage offered to employees must be “affordable” and must provide “minimum value” to your full-time employees and their dependents. If coverage is not affordable or does not offer minimum value, a business could be subject to a penalty if at least one full-time employee receives a premium tax credit for individual coverage purchased through Covered California, the state public exchange set up in connection with the ACA.

The ACA affordability threshold changes annually. In 2019, coverage was considered affordable if the lowest-cost, self-only coverage option available to employees did not exceed 9.86 percent of an employee’s household income (up from 9.56 in 2018). In 2020, the threshold has been reduced to 9.78 percent.

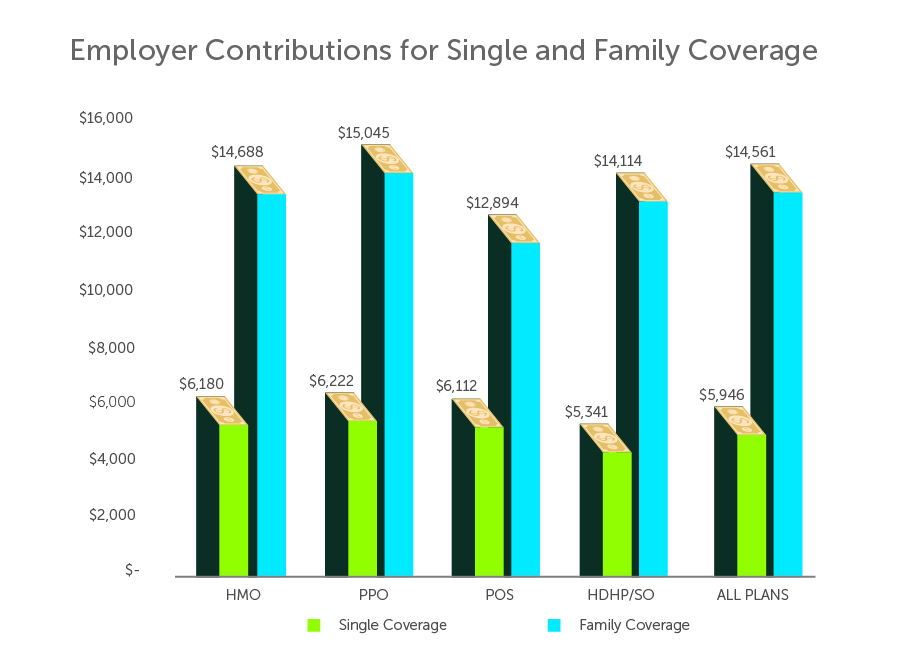

Average Costs for Employers

The 2019 Kaiser Family Foundation (KFF) Employer Health Benefits Survey found that employers were contributing an average of 77% of a plan’s cost. However, that 77% is not uniform across the board. Upon closer inspection, the average was found to fluctuate based on coverage. For example, employers were found to contribute 82% for single coverage, while contributing just under 71% for family coverage. That translates into an average contribution cost of $5,946 for single coverage and $14,561 for family coverage.

Your Contribution Options

Generally, for employer-sponsored health coverage, insurers require a contribution from the employer of at least 50%. In this scenario, the cost is contingent on several key factors such as carrier, plan type, provider network, and location. A viable alternative, like CaliforniaChoice’s Defined Contribution, lets you choose your premium contribution. You can select a Fixed Percentage of costs (from 50% to 100%) or a Fixed Dollar Amount for each employee.

How Much Should You Pay?

There is no blanket answer to this question. However, there are several good reasons most businesses pay 20 to 30 percent above the required minimum:

- Good health coverage helps in recruiting new employees. A survey by the Harvard Business Review found 88% of respondents would choose a job that offers a lower salary with better health, dental, and vision insurance over an opportunity with a higher salary but lesser benefits.

- A strong employee benefits plan affects employee retention. A 2018 survey by the Society for Human Resource Management (SHRM) found more than half (56%) of U.S. adults said whether or not they like their health coverage is a key consideration in their decision to stay on their current job. Forty-six percent said health insurance was either the deciding factor or a positive influence in choosing their job.

- Comprehensive coverage helps reduce stress in the workforce. The Annual U.S. Employee Benefit Trends Study by Metlife found that 74% of employees agree that having comprehensive health care services provides peace of mind for the unexpected. It is well-documented that happy employees are more productive and use less sick time.

Tax Benefits

It is important to note that offering health insurance benefits to your employees is, generally, 100% tax deductible as an ordinary business expenses on your state and federal income taxes. For an additional tax benefit, be sure to ask your employee benefits agent about a Premium Only Plan (POP), which gives your employees the ability to pay their share of premiums with pre-tax dollars – while also reducing your payroll taxes.

Average Costs

In summary, the average business is paying around 77% of a health plan’s cost, which amounts to $10,253.50 per year. While it is very likely your workforce will benefit greatly from a high employer contribution, there are cost-controlling options, like Defined Contribution, that let you take control of your health care costs. Of course, contribution requirements are wholly dependent on your business’ status as an ALE. If you are unsure if your organization is an ALE, you can use the calculator on the HealthCare.gov website or one on the CaliforniaChoice website.

Get a Custom Quote

To learn about the coverage and contribution options available to you and your business, talk with your health insurance agent. You can request a custom quote and discuss value-added benefits available to your group. If you do not already have an employee benefits agent, it’s easy to search for one here.