Navigating the maze of employee benefits can be a difficult task for employers, especially when trying to find a health plan that fits the needs of a diverse and multi-generational workforce. Everyone on your team is unique, with their own set of health care needs. So, how do you tackle this challenge? Here are three key things to keep in mind as you explore options for your business and your team.

Designing a Flexible Employee Benefits Plan

How to evaluate different health plans: You can shop and compare plans on your own. Or, you can connect with an insurance agent or employee benefits broker to help you. Agents and brokers are licensed professionals who can search, compare, and enroll your group in a plan tailored to your specific needs and budget.

Even better, it won’t cost you anything to use an agent or broker to help you compare plans. They’re paid by the health plan to help you make the right choice for your group and your employees.

Considerations in selecting a plan: When choosing the best options for your employees, key considerations include: the breadth of the provider network, the scope of coverage — taking into account ACA metal tiers, deductibles, and copays — and, of course, the cost of premiums.

The provider network is made up of those doctors, specialists, and hospitals that a health plan member can visit when needing care. Health plans typically have in-network providers and out-of-network providers. Going to an in-network provider typically means you’ll have lower out-of-pocket costs for care.

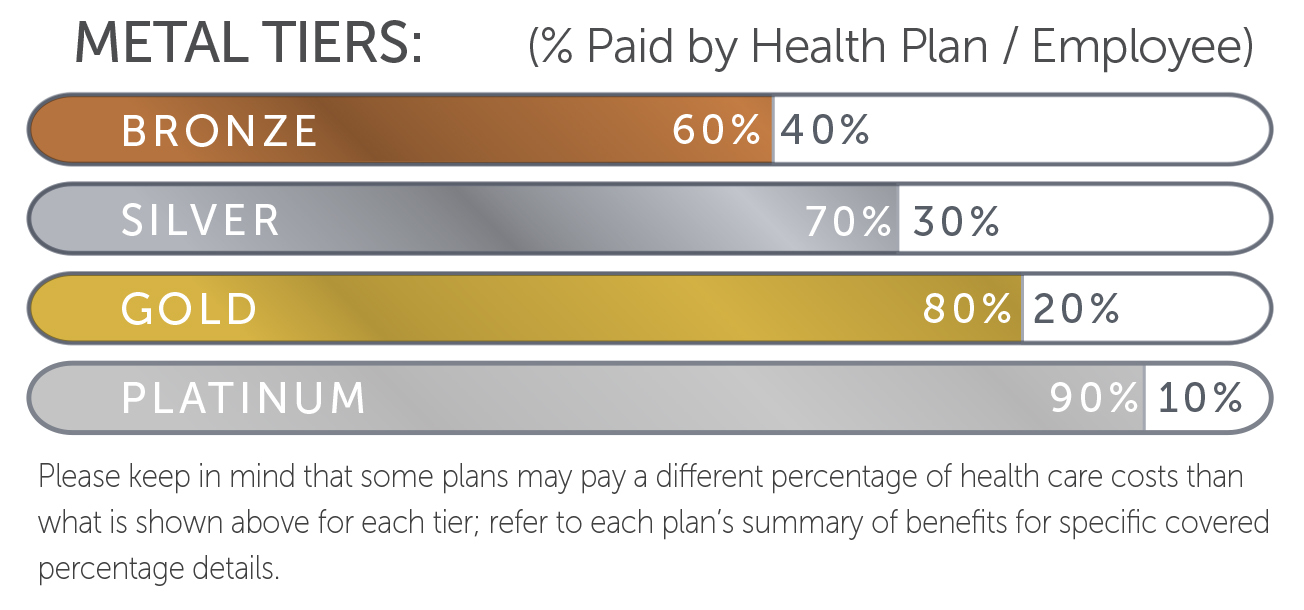

Coverage options usually include HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans. You may also be able to choose from EPO (Exclusive Provider Organization) plans and HSA (Health Savings Account) compatible HDHPs (High Deductible Health Plans). Plans are available in four Affordable Care Act (ACA) metal tiers: Platinum, Gold, Silver, and Bronze. The metal tier corresponds to the shared health care costs for the plan, as shown below.

The deductibles and copays for you and your employees will vary based on your plan type. Some plans have no calendar year deductible, depending on the plan type and tier. Copays vary by service type. Be sure to review the plan’s collateral for complete details.

What premiums you can expect: Plan premiums will vary by selected coverage and ACA tier. But what you pay may include “extras” for which you do not have any added costs. Many carriers and plans offer value-added services. For example, if you get no-cost Flexible Spending Accounts (FSAs) or Premium Only Plan (POP) services for your employees, you need to consider what you would normally pay for those if you have to purchase them elsewhere. Are there options for additional insurance if you and your employees want it? If so, at what added cost?

Making the Right Choice

When exploring your coverage options, consider the benefits offered by CaliforniaChoice. Since its launch in 1996, CaliforniaChoice has been revolutionizing the way small businesses and their employees access a diverse range of health insurance options — all through one streamlined program.

Today, after 28 years, CaliforniaChoice still offers the options employers and employees want most from an employee benefits program, including:

- Eight top-tier health plans: Anthem Blue Cross; Cigna + Oscar; Health Net; Kaiser Permanente; Sharp Health Plan; Sutter Health Plus; UnitedHealthcare; and Western Health Advantage.

- Cost control through Defined Contribution: you decide how much you want to contribute to your employees’ premiums. You can choose a Fixed Percentage (50% to 100%) of a specific plan and/or benefit or a Fixed Dollar Amount. (All employees must receive the same amount.)

- Multiple provider networks: greater access to doctors, specialists, and hospitals than any other program in California.

- Options for Dental, Vision, Chiropractic, and Life Insurance. There are Dental HMO and Dental PPO choices as well as a Voluntary Vision program, Chiropractic and Acupuncture plans, and Life and AD&D coverage with a living benefits provision.

- Value-added benefits through the Business Solutions Suite and Member Value Suite. These include FSAs, COBRA billing services, and a POP that allows employees to pay their portion of premium pre-tax. Dental, Vision, and Hearing services are also available as are discounts on fitness and wellness, movies, theme parks, water parks, hotels, and much more.

The flexibility offered by CaliforniaChoice is significant. You and your employees can choose from 130+ coverage options statewide. The availability of each plan depends on where you and your employees live. Some plans are available across the state, while others are regional.

Learn More from a Broker

Ask your insurance agent or employee benefits broker about how CaliforniaChoice offers your group a team-friendly plan design. It helps you offer more to your employees without costing you more. If you don’t already have a broker, we make it easy to search for one.