Offering group health insurance to employees – no matter what size your organization – is important. That’s because, more than at any other time in recent history, current and potential employees are seeking a better work and benefits experience. That’s what MetLife reports in its 2018 U.S. Employee Benefit Trends Study. Even if your business is not “required” to offer health benefits, it might still be something to consider – as you compete for workers in an increasingly competitive talent marketplace.

How to Qualify for Group Health Insurance

Let’s start by discussing what group health insurance is, and the rules concerning who qualifies for coverage? A group health insurance policy is one issued to an employer to provide coverage for eligible full-time employees. At the discretion of the employer, it may also include benefits for part-time employees (those working fewer than 30 hours per week) and/or the qualified dependents of employees.

If an employer offers any full-time or part-time employees health coverage, it must offer insurance to all employees, regardless of any pre-existing medical conditions.

Health insurers will write groups with as few as two covered persons (the business owner and an employee). However, some carriers will not write a policy for a husband and wife group if both are owners of the business, or if it is a sole proprietorship. Other business types such as an LLC, S-Corp, C-Corp, and Partnerships where the spouse is a W-2 employee are acceptable.

ACA Requirements for Small Businesses

The Affordable Care Act (ACA) employer mandate (still in force despite the House of Representatives’ effort to change it) requires employers with 50 or more full-time and full-time equivalent employees to offer health insurance. (Link here to the Healthcare.gov website for a calculator to determine your group size.)

Fifty-plus employers who do not offer eligible employees affordable coverage that includes what the ACA defines as “essential health benefits” are subject to a penalty. However, employers with fewer than 50 employees are not required to offer health benefits, and are not subject to a penalty – although many choose to offer benefits as part of their recruitment and retention strategy.

Group Health Coverage Costs

If you decide to purchase group health insurance for your employees, whether you pay the full cost of coverage or you share the cost with employees, what you pay is based on the ages of those individuals insured under your plan (including any dependents).

You will be able to choose from four ACA metal tiers: Bronze, Silver, Gold, and Platinum, each offering a different shared health care cost percentage, as shown in the graphic below:

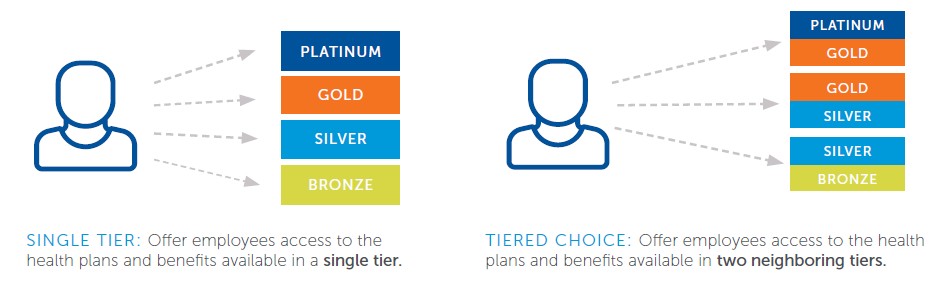

Some programs – including the CaliforniaChoice multi-carrier private exchange – allow you to choose more than one metal tier for your employees’ coverage. This gives you and your workers greater access to doctors, hospitals, and other providers offered by the eight plans available from CaliforniaChoice, so you can find the plan that’s right for your individual or family health care needs.

In addition, with CaliforniaChoice, you can more easily manage your employee benefits budget using Defined Contribution. You select your preferred plan and decide how much you want to spend on employees’ health insurance. You can choose a Fixed Percentage of the costs (from 50% to 100%) or a Fixed Dollar Amount. The choice is yours – and your cost per employee is locked-in for a year. At renewal, you can adjust your contribution (up or down) and lock it in for another 12 months.

Guaranteed Access

If you’re a small employer (with two to 50 full-time employees) and you want to offer health insurance to your employees, federal law guarantees your access to it. To learn more, contact your employee benefits broker. If you don’t already have a broker, we can help you find a CaliforniaChoice broker, who will work with you to build an affordable health plan quote that meets your employees’ needs.

Pro Tip: Broker services are typically available at no cost.