Health insurance is important when it comes to protecting your employees’ future financial security and ensuring they have access to health care when they need it. But how can you and your employees be sure you’re making the right choices when it comes to selecting your health insurance plan? CaliforniaChoice makes it easier to find the right plan at the right price, based on your individual or family health care needs and your anticipated plan usage.

CaliforniaChoice offers a range of publicly available tools on its website (www.calchoice.com) to help you and your employees:

1. Automated Choice Profiler: compare plans based on your health care needs

2. Online Provider Search: find the doctors you want

3. Online Rx Search: ensure the prescriptions you take are covered

4. Affordable Care Act (ACA) Calculators: determine how the ACA impacts your business

5. HR Calculators: calculate the cost of new hires, turnover, and overtime for your business

Let’s take a look at each of these tools separately:

1. Automated Choice Profiler

Using the Automated Choice Profiler, you have the power to compare coverage from seven different health plans (Anthem Blue Cross, Health Net, Kaiser Permanente, Sharp Health Plan, Sutter Health Plus, UnitedHealthcare, and Western Health Advantage). Your comparison is not based just on your premium but also on:

- the availability of your preferred doctors, medical group/IPA, and hospitals

- quality and affordability (like your deductible and co-pays)

- how you use your health insurance (or how you expect to in the future)

A great resource to help you or your employees when shopping and comparing plans, the Automated Choice Profiler takes into consideration:

- how often you visit the doctor

- out-of-pocket costs (like your deductible, plan co-pays, and co-insurance)

- your projected costs (based on what you can and can’t predict)

- your preferred doctors – and whether they’re “in network” for the plans you’re considering

- the overall quality of your health plan options (including feedback from plan members)

|

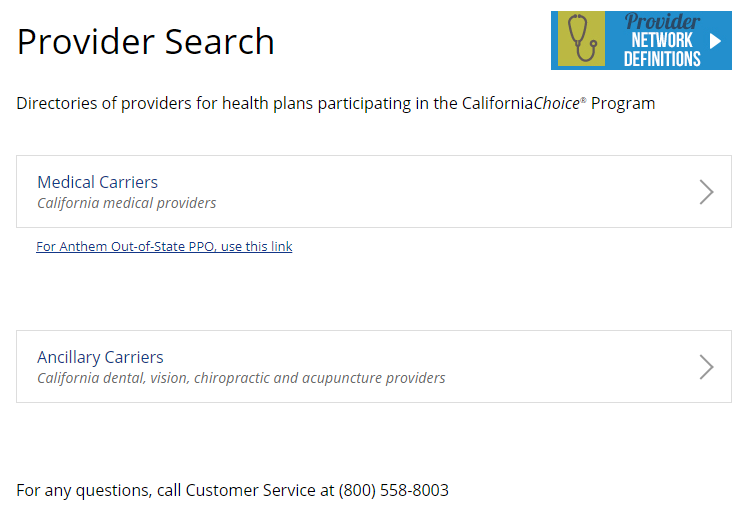

2. Online Provider Search

This tool can help you and your employees ensure your potential new health plan includes the doctors, medical groups, and hospitals you want after you enroll. It’s easy to use – just enter your home or work ZIP Code and the carriers you’re considering. You can then narrow your search by the doctor’s first and/or last name, distance from the ZIP Code you’ve entered, medical specialty, languages spoken, ACA metal tier (Bronze, Silver, Gold, or Platinum), medical group/IPA and hospital affiliation, and the type of coverage (e.g., EPO, HMO, PPO).

|

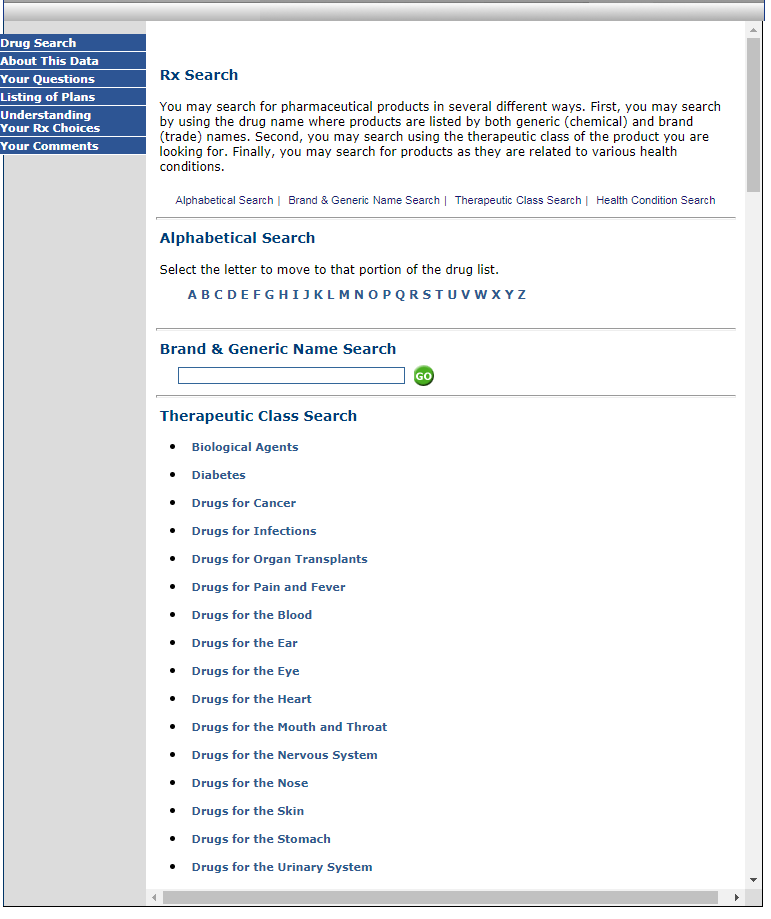

3. Online Rx Search

This tools lets you search for prescription drugs by name, treatment, or the medical condition with which they are most-often prescribed. You can search by brand name or generic class and by condition. You’ll get an easy-to-understand display of how the Rx is covered (or not covered) for each plan you’re considering.

|

|

4. ACA Calculators

The ACA’s reporting requirements and employer mandate apply only to employers with 50 or more full-time equivalent employees. The CaliforniaChoice ACA Full-Time Equivalent Calculator helps you determine whether that includes your business. The ACA Penalties Calculator helps you determine your possible penalties if you’re required to offer ACA-compliant coverage and you don’t. The ACA Safe Harbor Calculator helps you determine your plan “affordability” under one or more “safe harbors” of the ACA.

|

|

5. HR Calculators

CaliforniaChoice also offers HR Calculators to help you determine how much it costs to recruit and hire a new employee – and how employee turnover and overtime affect your business.

|

|

All of these tools are available in the CaliforniaChoice website. No registration or login is required. Use them before you talk with your broker. They can really help you when it comes to searching and comparing plans – and making the right choice for your employees and your business.

If you don’t already have an employee benefits broker, we can help you find a CaliforniaChoice broker to speak with about a health insurance quote for your employees.